- What is Pre- Seed Funding ?

- When would be the best moment to secure funding for your pre-seed startup?

- What is difference between Pre-Seed Funding and Seed Funding ?

- What is Pre-Seed Money raised for ?

- What goals and objectives can you set when you are seeking pre-seed funding for a startup?

- How to build an MVP that helps raised money from investors for your startup?

- How Ways and Means Technology helped imoji bag $2 million funding and an eventual acquisition by a Silicon Valley giant ?

- What are the steps that you as a startup founder should follow to raise pre-seed capital ?

- Where to look for pre-seed funding ?

- What role can Ways and Means Technology play in raising funds for your business ?

- Frequently Asked Questions

Starting a new business or a startup requires essential elements like equipment, office space, and employees, which require financial backing. Seed funding and pre-seed funding are vital sources of external funding for startups. Lack of funding can lead to failure of a business in launching a product or service in the market. The terminology used in funding rounds may be confusing for first-time entrepreneurs.

Although seed funding is a commonly known concept, pre-seed funding is equally important to understand. Pre-seed funding can take precedence over seed funding in certain situations as investors provide capital based on a company’s business idea.

If you want to know more about pre-seed funding, keep reading. This article will explain the meaning and importance of pre-seed funding for startups, how it works, and how to get started with it. It will also highlight the difference between pre-seed startup funding and seed funding, along with information on how much pre-seed funding to raise and the various sources available for it. So, let’s get started.

What is Pre- Seed Funding ?

Pre-seed funding is an early stage financing round that occurs before the seed funding round. It is the earliest stage of funding that a startup can receive, and it is usually provided by the founders, their family and friends, or angel investors. The pre-seed stage is when a startup is still in the idea or concept stage, and the funding is used to develop a prototype, conduct market research, and validate the business idea. The amount of pre-seed funding is usually small and ranges from a few thousand to tens of thousands of dollars. Pre-seed funding is important for startups to get their business off the ground and attract more significant investments in the future.

To understand with further simplification:

- Pre-seed funding is the earliest stage of funding that a startup can receive, and it typically comes from the founders, their family and friends, or angel investors.

- Pre-seed funding is used to develop a prototype, conduct market research, and validate the business idea.

- The amount of pre-seed funding is usually small, ranging from a few thousand to tens of thousands of dollars.

- Pre-seed funding is important for startups to get their business off the ground and attract more significant investments in the future.

- Founders should have a clear business plan and pitch to attract pre-seed funding.

- Investors will typically look for evidence that the business idea has potential, such as a strong team, a large market opportunity, and a unique product or service.

- Pre-seed funding can help startups build momentum and attract more investors in future rounds of funding.

- Founders should be prepared to give up a percentage of equity in their company in exchange for pre-seed funding.

- Pre-seed funding can also come with additional benefits, such as mentorship and networking opportunities.

- Finally, founders should understand that pre-seed funding is just the beginning of the fundraising process, and they will need to continue seeking funding as their business grows and evolves.

When would be the best moment to secure funding for your pre-seed startup?

The best moment to secure funding for your pre-seed startup depends on several factors, such as the stage of your company, the progress made in developing your business idea, and your financial needs. Generally, it’s advisable to start seeking pre-seed funding when you have a clear business concept, have conducted market research, and created a minimum viable product (MVP). At this stage, you can approach angel investors or venture capitalists who are interested in supporting early-stage startups.

However, it’s important to note that there’s no one-size-fits-all answer to this question. Some startups may need to secure funding earlier in the pre-seed stage, while others may wait until they’ve made more progress in their product development or market validation. It’s crucial to have a solid understanding of your business needs and financial requirements before seeking funding. You should also be prepared to present a clear and convincing business plan and demonstrate your team’s expertise and potential for success.

As a founder, here are some indications that you might be ready to start meeting with pre-seed investors:

- You have a clear and compelling business concept: Investors will want to see that you have a well-defined business concept that solves a real problem in the market.

- You have a minimum viable product (MVP) or prototype: Investors want to see that you have made some progress in developing your product or service, and having an MVP or prototype can demonstrate that you are making tangible progress.

- You have a strong founding team: Investors will want to see that you have a team with complementary skills and experience that can execute on your business plan.

- You have done some market research: Investors want to see that you have a good understanding of your target market, your competition, and your business model.

- You have a clear plan for how you will use the funds: Investors want to see that you have a plan for how you will use the funds you raise and that you have thought through the key milestones you need to achieve to move your business forward.

- You have a pitch deck and financial projections: Investors will want to see that you have a well-prepared pitch deck that clearly communicates your business concept, market opportunity, and financial projections.

You have a professional online presence: Investors may look you up online, so having a professional website, social media presence, and LinkedIn profile can help you make a good impression.

Also read: Five Ways to Raise Money for the Creation of Your Startup

What is difference between Pre-Seed Funding and Seed Funding ?

| Differentiator | Pre-Seed Funding | Seed Funding |

|---|---|---|

| Funding Amount | Typically less than $1 million | Ranges from $1 million to $5 million |

| Funding Stage | Earliest stage of funding | Follows pre-seed funding and precedes Series A funding |

| Investor Requirements | May not require a complete business plan or a proven track record | Requires a solid business plan and a proven track record |

| Investor Requirements | Focuses on business concepts and ideas | Focuses on the startup’s potential for growth and scalability |

| Use of Funds | Funds are typically used for market research, product development, and hiring initial team members | Funds are used for scaling the business, expanding operations, and increasing market share |

| Equity Dilution | Typically requires a higher equity dilution for the startup as investors are taking on a higher risk | Requires a lower equity dilution as the startup has already gained some traction and proven its concept |

| Funding Sources | Typically requires a higher equity dilution for the startup as investors are taking on a higher risk | Angel investors, venture capitalists, and corporate investors |

Note: The above table provides a general overview of the differences between pre-seed funding and seed funding, and the actual differences may vary depending on the specific startup and its funding requirements.

What is Pre-Seed Money raised for ?

Pre-seed money is generally used for the following purposes:

1. Idea validation: Pre-seed funding is often used to validate the business idea and to conduct market research to see if the product or service has a viable market.

2. Prototype development: Pre-seed money can also be used to develop a prototype or Minimum Viable Product(MVP) or proof-of-concept of the product or service to demonstrate to potential investors or customers.

Also Read: Comparing Prototype, POC and MVP in mobile app development: what approach to follow ?

3. Team building: A portion of pre-seed money is often used to build the team and hire key employees who can help the company grow and succeed.

4. Legal and administrative costs: Pre-seed funding can also be used to cover legal and administrative expenses, such as registering the company, obtaining patents or trademarks, and complying with regulatory requirements.

5. Initial marketing and sales: Pre-seed money can also be used to fund initial marketing and sales efforts to attract customers and build awareness of the company and its products or services.

It’s important to note that the specific use of pre-seed money can vary depending on the startup’s industry, business model, and stage of development.

What goals and objectives can you set when you are seeking pre-seed funding for a startup?

When trying to raise pre-seed funding for startups, the main aim should be to secure enough funding to get the company off the ground and develop the business concept to a stage where it is attractive to seed investors.

Pre-seed funding is typically raised to cover the costs associated with product development and testing, hiring key personnel, and building out a basic infrastructure. The goal is to establish a minimum viable product (MVP) and demonstrate some traction to investors in order to secure follow-on funding.

Also Read: Creating an MVP that Impresses Investors: Tips for Securing Funding for Your Mobile App

Here are some detailed points to consider when aiming to raise pre-seed funding for your startup:

- Determine your funding requirements: Before you start raising funds, it’s important to know how much capital you need to raise to achieve your goals. Consider the cost of product development, marketing, staffing, and other expenses that will be necessary to get your business off the ground.

- Build a strong pitch: You need to have a compelling pitch to convince investors to back your startup. Clearly articulate your business concept, target market, unique value proposition, and your team’s qualifications and experience.

- Identify potential investors: Look for investors who have experience in your industry and are likely to be interested in your business concept. You can start by seeking out angel investors, venture capital firms, and startup incubators.

- Network: Attend startup events, join entrepreneur groups, and network with other founders to build relationships with potential investors. You never know who might be interested in investing in your startup.

- Develop a business plan: A comprehensive business plan can help you attract investors and show that you have a solid plan for growing your business. Include market research, financial projections, and a clear roadmap for achieving your goals.

- Create a pitch deck: A well-designed pitch deck can help you communicate your business concept and potential to investors. It should include key metrics, such as market size, growth potential, and competitive advantage.

- Demonstrate traction: Investors want to see evidence that your business concept is gaining traction. This could include user sign-ups, revenue growth, or partnerships with other companies.

- Be transparent: Be honest and transparent about the risks and challenges associated with your business. Investors will appreciate your candor and it will help build trust in your startup.

- Negotiate terms: Once you have secured interest from investors, negotiate the terms of your pre-seed funding round. This includes the amount of equity you will give up in exchange for the funding and any other terms of the agreement.

By keeping these points in mind and putting in the effort to build a strong pitch, network with potential investors, and demonstrate traction, you can increase your chances of successfully raising pre-seed funding for your startup.

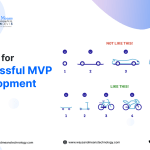

How to build an MVP that helps raised money from investors for your startup?

Building a minimum viable product (MVP) that can attract funding for your startup involves several crucial steps that can increase your chances of success. Here are some guidelines to help you build an MVP that can raise money for your startup:

- Identify a clear problem: You need to identify a specific problem or pain point that your target market is experiencing. This will help you to develop a product that addresses a real need and has a clear value proposition.

- Conduct market research: Conducting thorough market research will help you understand your target audience, the competition, and the overall market landscape. This information will help you make informed decisions when developing your MVP.

- Define your MVP features: Based on your market research and problem identification, define the key features of your MVP. Keep in mind that your MVP should be a simplified version of your final product, with only the most essential features.

- Build your MVP: Use your defined MVP features to build your product. Focus on delivering a product that is functional and demonstrates your unique value proposition.

- Test and iterate: Once you have built your MVP, test it with your target audience to gather feedback. Use this feedback to iterate and improve your product.

- Develop a pitch deck: Create a compelling pitch deck that communicates your product’s value proposition, target market, competition, and business model. This deck will be essential when pitching your MVP to potential investors.

- Create a funding strategy: Determine how much funding you need to raise and create a strategy to secure funding from investors. This may involve attending pitch events, reaching out to angel investors or venture capitalists, or crowdfunding.

By following these steps, you can build an MVP that has a strong chance of attracting funding for your startup.

Also Read: 5 Key Reasons Why MVP Development is Important for Your Business

How Ways and Means Technology helped imoji bag $2 million funding and an eventual acquisition by a Silicon Valley giant ?

Imoji was able to secure a funding of $2M with the assistance of Ways and Means Technology, which contributed to making the testing and messaging experience more engaging and fun. The team at Ways and Means Technology initiated the project by gaining a comprehensive understanding of the client’s vision for the product and incorporating MVP features that would help achieve the set objective.

To achieve this, the team at Ways and Means Technology utilized advanced technologies such as artificial intelligence and image processing to simplify the process of turning selfies and other pictures into stickers for texting. The focus was on making the entire process time-friendly and user-friendly, which ultimately proved to be instrumental in helping Imoji build a successful startup and secure funding.

The team at Ways and Means Technology further optimized the process by introducing various tools such as zoom, crop, and a final cut out that significantly reduced the time required for emoji generation. These efforts not only helped Imoji secure seed funding but also played a vital role in their eventual acquisition by Giphy in 2017.

What are the steps that you as a startup founder should follow to raise pre-seed capital ?

As a startup founder, raising pre-seed capital can be a daunting task. Pre-seed funding is typically used to develop your idea into a minimum viable product (MVP), so it’s crucial to get it right. Here are some initial brief and point-by-point steps to follow:

Initial brief

Start with a solid business plan: Before you even begin approaching investors, you need to have a solid business plan in place. This plan should include a detailed description of your business, the problem you are solving, your target market, and how you plan to generate revenue. It should also include a timeline for development and growth.

Research

Do your homework: Research different investors and determine which ones would be a good fit for your company. Look at their investment history, the types of startups they typically invest in, and their investment size.

Pitch deck

Create a compelling pitch deck: To attract investors, you need to create a persuasive pitch deck. It is a graphical representation of your business plan that should comprise details about your team, market analysis, financial forecasts, and MVP, and is created once you have identified potential investors.

Practice

Practice your pitch: Once you have created your pitch deck, you need to practice your pitch. You should be able to explain your business and your MVP in a concise and compelling way.

Networking

Attend networking events: Networking events can be a great way to meet potential investors. Attend startup events, conferences, and meetups in your industry to connect with people who may be interested in investing in your company.

Approach investors

Reach out to investors: Once you have identified potential investors and refined your pitch, it’s time to reach out to them. You can do this through email, social media, or by attending events where they will be present.

Follow-up

Follow up with potential investors: After you have reached out to investors, it’s important to follow up with them. Send them your pitch deck and any additional information they may have requested.

Negotiation

Negotiate the terms of the investment: If an investor is interested in investing in your company, you will need to negotiate the terms of the investment. This includes the amount of money they will invest, the equity they will receive, and any other conditions they may have.

Close the deal

Once you have agreed on the terms of the investment, you will need to close the deal. This typically involves signing a term sheet and other legal documents.

In summary, raising pre-seed capital requires a solid business plan, research on potential investors, a compelling pitch deck, networking, reaching out to investors, follow-up, negotiation, and closing the deal. It’s important to remember that raising capital is a process, and it takes time and effort to find the right investors for your company.

Where to look for pre-seed funding ?

There are several places to look for pre-seed funding for startups. Here are some of the most common sources:

- Friends and Family: You can start by pitching your idea to your family and close friends who believe in your vision and are willing to invest in your startup.

- Angel Investors: Angel investors are high net worth individuals who invest in early-stage startups in exchange for equity. They can provide pre-seed funding and also offer valuable guidance and mentorship.

- Venture Capital Firms: Venture capital firms provide funding to startups in exchange for equity. While most venture capitalists focus on later-stage startups, there are some firms that invest in pre-seed and seed-stage startups.

- Crowdfunding Platforms: Crowdfunding platforms like Kickstarter and Indiegogo allow startups to raise money from a large group of people in exchange for rewards or equity.

- Incubators and Accelerators: Incubators and accelerators are programs that provide resources, mentorship, and funding to startups. While not all programs provide pre-seed funding, some do offer small investments in exchange for equity.

- Government Grants: Depending on your location and industry, there may be government grants available for startups. These grants can provide pre-seed funding and also help you access resources and connections.

- Business Competitions: Many business competitions offer cash prizes and funding opportunities for startups. These competitions can be a great way to gain exposure and secure pre-seed funding.

It’s important to do your research and find the best fit for your startup when seeking pre-seed funding. Each source of funding comes with its own advantages and disadvantages, so consider your goals and values when choosing where to look for funding.

What role can Ways and Means Technology play in raising funds for your business ?

As a technology consulting firm, Ways and Means Technology can play a significant role in helping startups raise pre-seed funding by providing technical expertise, market knowledge, and connections to potential investors. Here are some of the ways we can help:

- Building a Minimum Viable Product (MVP): We can help you develop a prototype or MVP that demonstrates your product or service’s potential to investors. This can include UI/UX design, software development, and testing to ensure that your product is market-ready.

- Providing Technical Expertise: Our team of experts can help you identify the technology stack required to develop your product and assist with technical challenges that arise during the development process.

- Introducing You to Potential Investors: Our extensive network of contacts in the startup ecosystem, including angel investors, venture capitalists, and other funding sources, can be instrumental in connecting you with the right investors.

- Preparing Pitch Decks: Our team can assist you in preparing pitch decks that effectively communicate your product, business model, and potential to investors.

- Providing Market Knowledge: We can help you conduct market research to understand your target audience, competitors, and potential market size, which can be useful in convincing investors to fund your startup.

By leveraging our technical expertise, market knowledge, and connections, we can help startups raise pre-seed funding and take their businesses to the next level.

Frequently Asked Questions

What is seed funding, and how does it differ from other forms of financing?

Seed funding is the initial funding raised by a startup to launch its product or service. It typically comes from angel investors, venture capitalists, or crowdfunding. Seed funding is different from other forms of financing as it is the first external investment in a company, and the investors take a higher risk in exchange for a higher return. Ways and Means Technology can help founders understand the nuances of seed funding and connect them with potential investors.

How much seed funding should I raise?

The amount of seed funding a startup should raise depends on several factors, such as the product or service’s complexity, the market’s size, and the team’s experience. However, a general rule of thumb is to raise enough funds to cover 18-24 months of operating expenses. Ways and Means Technology can assist founders in determining the ideal amount of seed funding they should raise based on their startup’s unique requirements.

What do investors look for when considering a seed funding round?

Investors typically look for startups with a solid business plan, a clear understanding of their target market, a well-defined product or service, a competent team, and a plan for growth. They also consider the startup’s potential to disrupt an existing market and the founder’s passion for their venture. Ways and Means Technology can help founders prepare their pitch deck, business plan, and other materials that will make their startup more attractive to potential investors.

What is the typical equity split between the founder and the investors in a seed funding round?

The equity split in a seed funding round can vary widely, depending on the startup’s valuation, the amount of funding raised, and the investor’s preferences. However, a common range for founder equity is between 20% and 40%, with investors holding the remainder. Ways and Means Technology can provide founders with guidance on how to negotiate favorable equity terms in their seed funding round.

How long does it typically take to secure seed funding?

The timeline for securing seed funding can vary depending on the startup’s industry, the size of the investment, and the availability of interested investors. On average, it can take between three and six months to close a seed funding round. However, the process can take longer or shorter depending on various factors. Ways and Means Technology can assist founders in preparing for their seed funding round and connecting them with potential investors to expedite the process.